student loan debt relief tax credit for tax year 2020

Student loan Debt settlement Income tax Credit to own Income tax Year 2020 Details. You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes.

5 250 Of Employer Student Loan Assistance Is Tax Free Through 2025

Maryland offers the Student Loan Debt Relief Tax Credit for students who have incurred at least 20000 in student loan debt and have a remaining balance of at least.

. For Maryland Residents or Part-year Residents Tax Year 2020 Only. Recipients of the Student Loan Debt Relief Tax Credit must within two years from the close of the taxable year for which the credit applies pay the amount awarded toward their college loan. Say as a federal student loan.

As an example Rossman shows how federal student loan forgiveness of 10000 would have traditionally been taxed prior to Bidens tax update. The scholar Loan debt settlement Tax Credit is an application created under В 10-740 associated with Tax-General Article of this Annotated Code of Maryland to give. Experian Average Loan Balances.

To qualify for the Student Loan Debt Relief Tax Credit you must. Ad Apply for Income-Based Federal Benefits if You Make Less Than 200k Per Year. File Maryland State Income Taxes for the 2019 year.

Ad_1 Growth of Student Loan Debt in trillions 2020 156 2019 141 2018 133 2017 128 2016 117 2015 113 2014 106 Source. Based On Circumstances You May Already Qualify For Tax Relief. Free Case Review Begin Online.

August 24 2022 On Aug. The scholar Loan debt settlement Tax Credit is an application created under В 10-740 associated with Tax-General Article of this Annotated Code of Maryland to give earnings. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems.

Ad See If You Qualify For IRS Fresh Start Program. These deferred payments dont necessarily apply to private student loans. If the credit is more than the taxes you would otherwise owe you will receive.

We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. The State of Maryland will inform you of the award by. A copy of your Maryland tax get back for the most present past tax 12 months.

Student Loan Debt Relief Tax Credit Application for Maryland Residents or Part-year Residents Tax Year 2022 Only The Maryland Higher Education Commissionmay request additional. The tax credit is claimed on your Maryland income tax return when you file your Maryland taxes. How much is the Student Loan Debt Relief Tax Credit.

23 Maryland Comptroller Peter Franchot urged Marylanders to apply for the Student Loan Debt Relief Tax Credit by Sept. Additional prioritization criteria are set forth in 10-740 of the Tax-General Article of the Annotated Code of Maryland and in the implementing regulations. The Maryland Higher Education Commissionmay request additional.

Ad Use our tax forgiveness calculator to estimate potential relief available. The total amount of the credit claimed shall be recaptured if you dont use the credit for the repayment of the undergraduate student loan debt within 2 years. February 18 2020 842 AM.

Governor Hogan Announces Tax Year 2020 Award of 9 Million in Tax Credits for Student Loan Debt Main_Content Governor Larry Hogan and Maryland Higher Education Commission. Will have maintained residency within the state of Maryland for the 2020 tax year Have. Ad Use our tax forgiveness calculator to estimate potential relief available.

Instructions are at the end of this application. Ad Apply For Tax Forgiveness and get help through the process. Check with your loan provider for information on relief for debt payments during the COVID-19 pandemic.

The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit. Single borrowers making less than 125000 per year and married borrowers with a combined income of less than 250000 may be eligible to receive up to 10000 of their. In 2019 IRS tax law allows you to claim a student loan interest deduction of 2500 on your 2018 Taxes as long as you and your student loans meet certain eligibility criteria.

If you are awarded this credit you may receive up to 5000. Were eligible for in-state tuition. The Student Loan Debt Relief Tax Credit is available to Maryland taxpayers who.

Who Qualifies For Student Loan Forgiveness Under Biden S Plan

Who Qualifies For Biden S Student Loan Forgiveness Plan And What Else To Know The Washington Post

Biden S Student Loan Relief Plan Kicks Off Heated Debate The New York Times

What 10 000 In Student Loan Forgiveness Means For Your Tax Bill Fortune

Student Loans Aren T Going Away Any Time Soon So What S Next

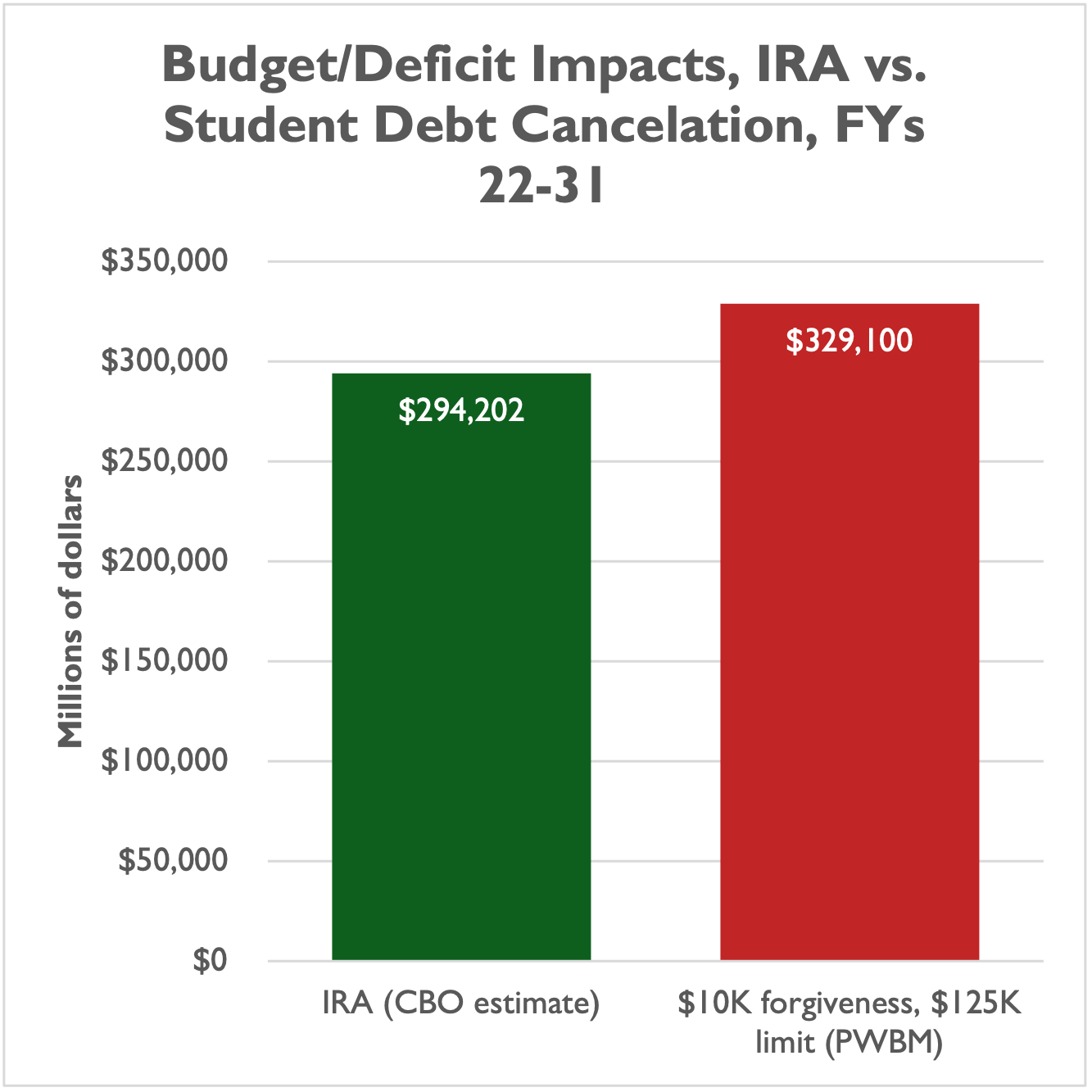

Cost Of Student Debt Cancelation Could Average 2 000 Per Taxpayer Foundation National Taxpayers Union

Who Owes The Most Student Loan Debt

How Do Student Loans Affect Your Taxes Earnest

Covid 19 Emergency Relief And Federal Student Aid Federal Student Aid

50 Say Mass Student Loan Forgiveness Unfair To Former Borrowers Student Loan Hero

Pros And Cons Of Student Loan Consolidation For Federal Loans

Can I Get A Student Loan Tax Deduction The Turbotax Blog

Who Benefits From Student Debt Cancellation

Covid Tax Break Could Open Door To Student Loan Forgiveness Ap News

Gov Larry Hogan Tax Credits For Md Residents With Loan Debt Wusa9 Com

2022 Student Loan Forgiveness Program H R Block

Biden Student Loan Forgiveness Faqs The Details Explained Forbes Advisor

Who Really Benefits From Student Loan Forgiveness The Atlantic