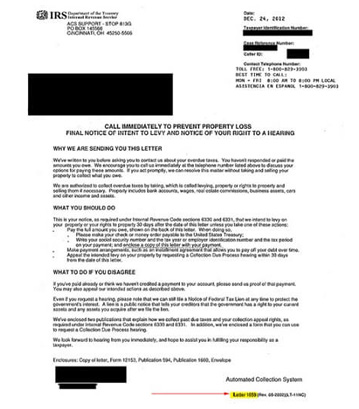

irs tax levy letter

You have a balance due. A notice was sent to you previously letting you know how much you owe when it was due and how to pay.

Irs Notice Cp523 Understanding Irs Notice Cp 523 Intent To Terminate Your Installment Agreement Seize Your Assets Pending

Even if you think you do not owe the tax bill you should contact the IRS.

. The actual levy is usually on. The IRS notifies you of its intent to levy by sending a Letter 11 or Letter 1058 Final Notice Notice of Intent to Levy and Notice of Your Right to a Hearing. It is different from a lien while a lien makes a claim to.

This notice is your Notice of Intent to Levy Internal Revenue Code Section 6331 d. Since the IRS did not hear from you it is continuing with its collection. For example if you have a tax debt the IRS can issue a levy which is a legal seizure of your property or assets.

This is the code the IRS puts on the final notice of intent. The notice may tell you that the IRS plans. This is the letter you receive before the IRS levies your assets.

If you dont pay the amount due immediately the IRS can levy your income and bank. The IRS can seize a residence if the taxpayer owes more than 5000 and the house has value under the tax seizure rules. Its a document that communicates the IRS.

If you receive an IRS bill titled Final Notice Notice of Intent to Levy and Your Right to A Hearing. If you have a tax debt the IRS can issue a levy which is a legal seizure of your property or assets. Taxpayers who owe federal back taxes and havent worked with the IRS to find a solution could receive a Notice of Intent to Levy.

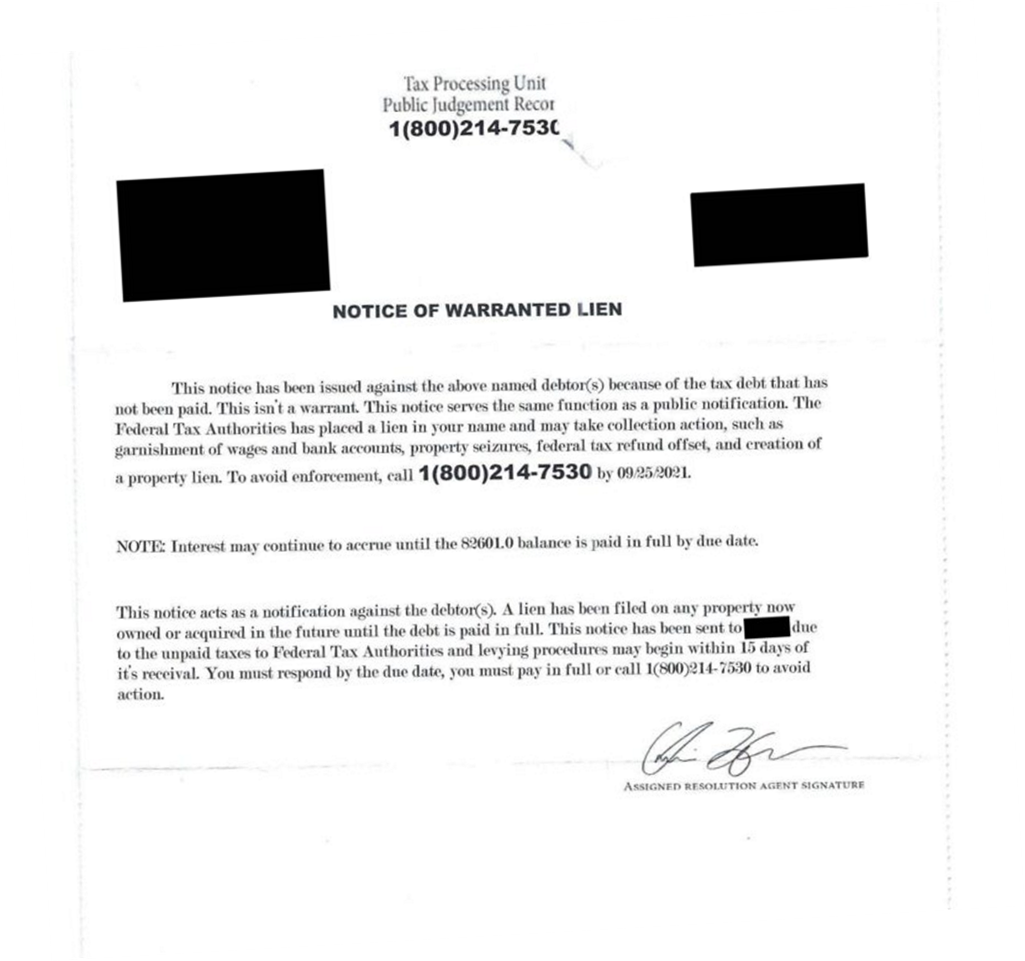

This letter hereby notifies you that we have received an IRS Tax Levy to withhold from your wages. Federal tax levies have priority over all other liens with the. Notice of intent to seize levy your property or rights to property.

The IRS sends notices and letters for the following reasons. We have a question about your tax return. This includes any property you acquire after the IRS.

The IRS is notifying the delinquent taxpayer that they will begin. An IRS levy letter also authorizes the Service to. This letter can be readily identified by looking at the upper right hand corner there you will see the identifiers LT11.

An IRS Notice of Levy is a letter sent to taxpayers who have not paid their back taxes and have an IRS lien placed against them. You are due a larger or smaller refund. The IRS sent you a Final Notice of Intent to Levy and Notice of Your Right to A Hearing levy notice at least 30 days before the levy.

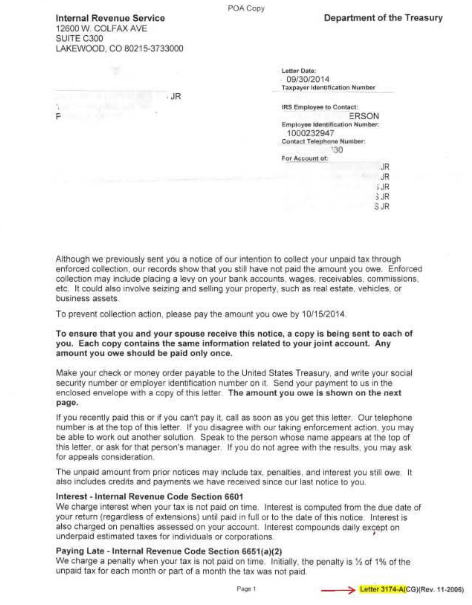

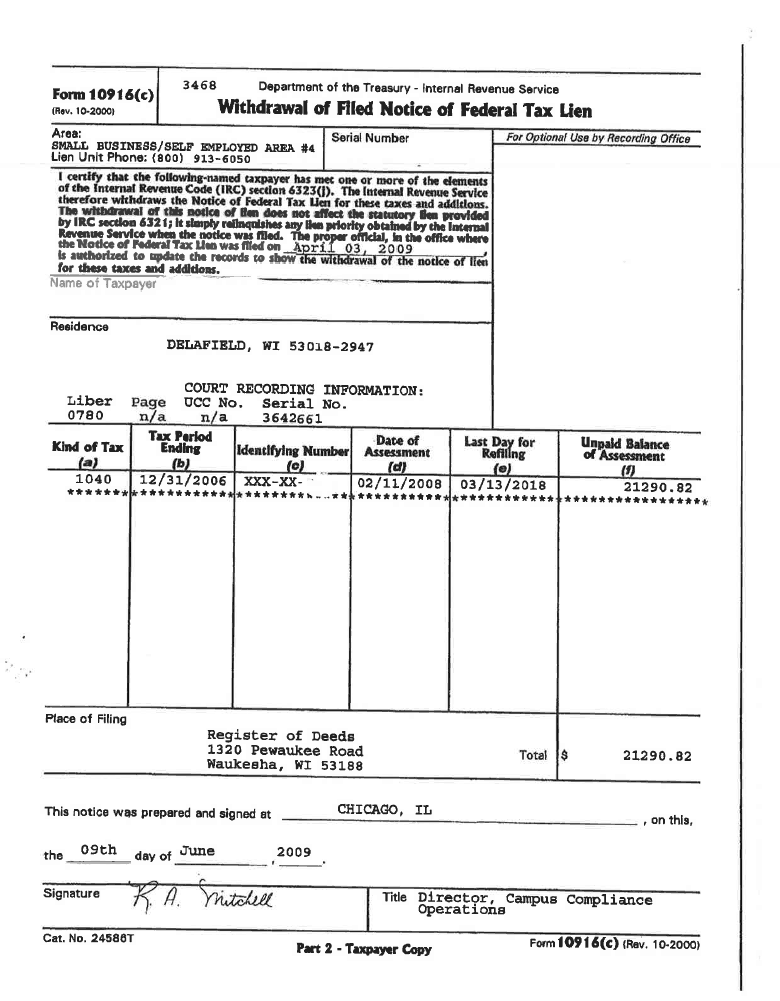

A tax lien is a tool the IRS uses to make a legal claim against property you own to secure payment of any tax debt you owe. A notice of levy from IRS is also called an IRS notice of intent to seize your property. The IRS may give you this notice in.

It is different from a lien while a lien makes a claim to your assets as. Sometimes considered an early notice because the IRS must notify you of your right to a hearing before.

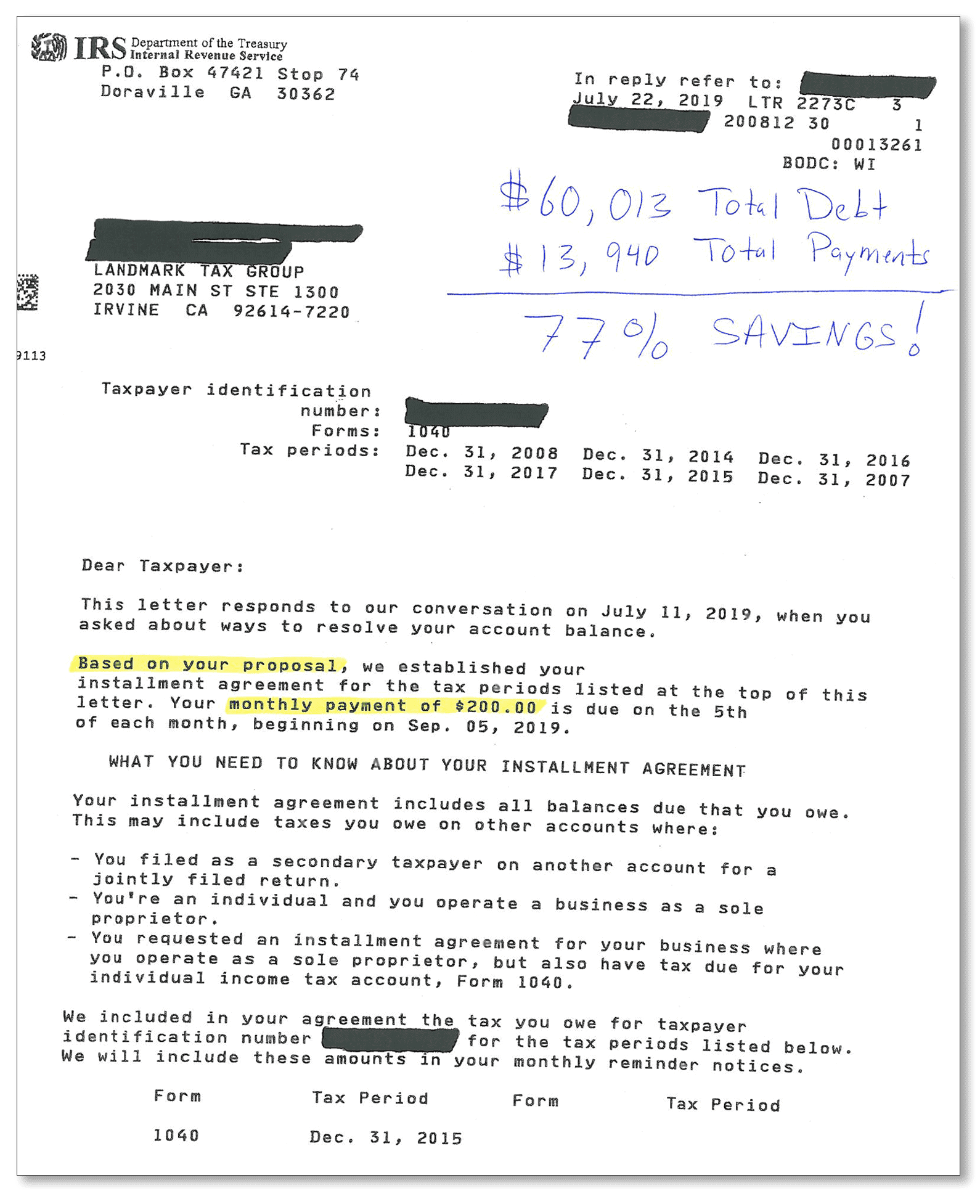

Our Case Results Landmark Tax Group

Irs Notice Cp504 Understanding Irs Notice Cp504 Notice Of Intent To Levy Immediate Response Required

Irs Letter 39 Lt39 Reminder Of Overdue Taxes H R Block

Irs Form 1058 Notice Of Intent To Levy

Irs Letter 3174 What It Means And How To Respond To It Supermoney

Irs Leins 9 Ways To Resolve Tax Leins Irs Tax Lien Help Faith Firm

5 12 7 Notice Of Lien Preparation And Filing Internal Revenue Service

How To Know If You Have Received A Fake Irs Collection Letter Irs Tax Attorney Howard Levy

Certified Letter From Irs Why Irs Sent Certified Mail

New Taxpayer Scam Fake Irs Letters Alfano Company Llc

Irs Letter 2050 Overdue Taxes Or Tax Returns

5 19 9 Automated Levy Programs Internal Revenue Service

Irs Levy Cp504 Notice Of Intent To Levy What You Should Do

How We Prevented Wage Garnishment And Home Seizure For A Client Landmark Tax Group

What Is A Notice Of Federal Tax Lien Rush Tax Resolution

How Can Scott Allen E A Help You With Your Mesa Az Irs Payment Plan Tax Debt Advisors